Balance of Risks

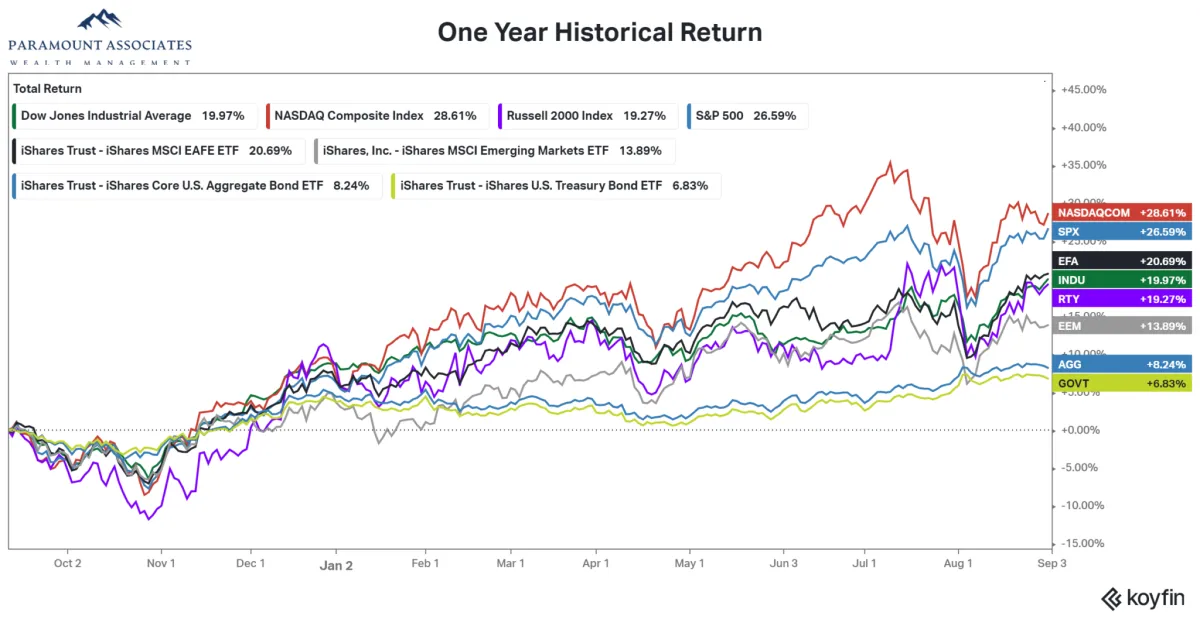

| Nasdaq Composite | +18.57% |

| S&P 500 | +19.53% |

| MSCI EAFA (Developed International) | +12.42% |

| Russell 2000 Value | +15.08% |

| Dow Jones Industrial Average | +11.75% |

| MSCI EM (Emerging Markets) | +9.86% |

| Aggregate Bond | +3.07% |

| Municipal Bond (10 yr) | +0.12% |

| High Yield Bond | +6.29% |

As of 8/31/24

*JP Morgan Weekly Market Recap; accessed 9/2/24

The pivot markets have been waiting for! The federal reserve’s pivot away from combating inflation and towards stabilizing employment is underway. Why? Inflation is coming down headlined by reductions in wage growth and shelter. Indeed, the US economy continues to expand at a rate of 2%-3% per year, and robust consumption figures persist. However, a closer examination reveals that some underlying weaknesses are starting to emerge. Earnings estimates are coming down and revenue projections are lagging expectations. Furthermore, unemployment has increased, and job openings are coming down. The greatest risk, you might inquire? According to the Federal Reserve, it would be the scenario where individuals start believing that the job market is deteriorating, leading them to curtail their spending.

As for asset management, it is a time to understand the risks in different investments. Will rates continue to drop helping bond performance? Will earnings keep up with lofty estimates? Will the stock market broaden, allowing different sectors and stocks to perform? Or will large firms continue to dominate market trends? Will international stocks hold up during a period of heightened geopolitical uncertainty? Where are investors able to find non-correlation in current markets?

These are some of the questions that investors are faced with. Market analysts often vary widely in their projections, which historically underscores the challenge of predicting market trends. Indeed, every research department that announced their year-end targets for the S&P 500, which I have followed, has been incorrect this year. Currently, the S&P 500 is trading above the highest estimate that was previously reported. This has been in anticipation of the federal reserve dropping interest rates, as they did last week. How much of this is already priced in, time will tell. Interesting that the markets are not always positive 1 year after the first rate cut by the fed. Why? Well, the federal reserve doesn’t lower rates because times are great. They lower rates because they see economics slowing – in this case the labor market. Don’t forget that the excess savings built up during the pandemic, has been spent…or that the heightened savings levels in the US during the pandemic have dropped drastically…or that credit card/auto loan deficiencies have begun to increase. We are not headed for a rapid deterioration in my opinion, however valuations versus momentum will prove more important as volatility picks up.

Our approach continues to be ‘stay alive and look for the ball’. That sports analogy is a perfect way to explain investment management in today’s economy. We expect significant divergence in asset classes and within different sectors. Tactically, it’s certainly desirable to be in the market for potential gains, but it is equally important to thoughtfully manage portfolio risk.

Scott Tremlett, CIMA®, CFP®, ChFC® | Managing Partner/Chief Investment Officer

| US Equity: | Overweight |

| Developed Int’l Equity: | Overweight United Kingdom; Underweight Japan; Underweight Europe |

| Emerging Markets Equity: | Overweight India; Underweight China; Underweight Brazil |

| US Government Bond: | Underweight |

| US Corporate Bond: | Neutral |

| International Bond: | Underweight |

| Emerging Markets Bond: | Underweight |

| REIT/Commodity: | Underweight |

| Alternative Assets: | Overweight |

| Preferred Sectors: | Financial Services, Industrials, Technology |

Allocation Update1

Equity Exposure: Top Holdings1

AerCap Holdings NV

Amazon.com, Inc

American Express Company

Applied Materials, Inc

Ares Management Corporation

Berkshire Hathaway Inc

Chubb Ltd

Crowdstrike Holdings, Inc

Eli Lilly and Company

General Motors Company

Group 1 Automotive, Inc

KKR & Co Inc

MercadoLibre Inc

Meta Platforms Inc

Microsoft Corporation

NextEra Energy Inc

NVIDIA Corp

Palo Alto Networks, Inc

PDD Holdings Inc, Sponsored ADR

RadNet, Inc

Sempra

Spotify Technology

Synopsis, Inc

One Year through 8/31/2023 – Nasdaq, Dow Jones Industrial Average (INDU), Russell 2000 (RTY), S&P 500 (SPX), Developed International (EFA), Emerging Markets (EEM), Aggregate Bond Index (AGG), US Treasuries (GOVT), Koyfin.com; accessed 9/08/2024

Paramount Global Rankings

(as of December 2024)

#1. India

Current Power: 1 – #1 in every category

Momentum: 17 – Significant growth outweighs concerns about momentum

Overall Rank: 1 – Overweight

Monetary Policy: 6.25%

Valuation: Overvalued

Manufacturers report substantial but more moderate increases in new business and production. Companies are raising their purchasing levels to guard against input shortages. Enhanced demand from Asia, Africa, Europe, and the US enables firms to offset additional costs by raising selling prices. Service firms have seen a solid rise in payroll numbers, supported by continued positive sentiment. The streak of new order growth has now reached 37 consecutive months. The service sector is driven by domestic market growth, as inflation drops to its lowest level since 2020.2

#2. China

Current Power: 3 – Strong Leading Indicators & GDP Growth

Momentum: 8 – Hurt by Services

Overall Rank: 2 – Underweight

Monetary Policy: 3.35%

Last change: Reduced July 2024

Valuation: Undervalued

Manufacturing operating conditions expanded for tenth consecutive month. New orders return to growth, supporting stabilization in employment after 11-month decline. Firms growing more optimistic. Services remain in growth however cost concerns are leading to reduced staffing levels.3

#3. Brazil

Current Power: 2 – Top 7 in every category

Momentum: 10 – Slowing

Overall Rank: 3 – Despite growing optimism, the current relative power remains at risk

Monetary Policy: 10.75%

Expected to Raise

Valuation: Undervalued

New business growth has slowed to its weakest level of 2024 thus far. Purchasing prices are increasing at their fastest rate in nearly 2.5 years, contributing to inflation reaching a 29-month high. Despite the current challenging operating conditions, manufacturers remain more optimistic about the year ahead, a positive outlook that has supported recent job creation.4

#4. United Kingdom

Current Power: 9 – Manufacturing (#2 ranking) headlines current power

Momentum: 2 – GDP recovers from near contraction

Overall Rank: 4 – Overweight

Monetary Policy: 5.00%

Last change: Reduced August 2024

Valuation: Undervalued

UK manufacturing at 26-month high in August fueled from broad based growth and further signs of easing price pressures. Output and new order volumes led to fastest job creation in over two years. Service business activity leads to employment growth for the eighth consecutive month.5

#5. South Korea

Current Power: 6 – #4 Manufacturing

Momentum: 7 – #1 Leading Indicators

Overall Rank: 5 – Domestic market leading to increased business optimism

Monetary Policy: 3.50%

Last change: Raised January 2023

Valuation: Slightly Overvalued

Client optimism is at its highest since May, driving the largest increase in production since April 2021. Job creation has reached a six-month peak, fueled by rising consumer confidence and new domestic client acquisitions. Additionally, price inflation has dropped to its lowest level in 2024.6

#6. Japan

Current Power: 8 – Led by Services and GDP strength

Momentum: 5 – #1 GDP Growth

Overall Rank: 6 – Underweight See International Stocks Will Outperform

Monetary Policy: 0.25%

Last Change: Raised July 2024

Valuation: Undervalued

Manufacturing production needs have led to a rise in input purchases for the first time since July 2022. While outstanding business remains sharply reduced, employment growth has recently accelerated. Services activity has grown in 23 of the past 24 months, with improving confidence particularly evident in domestic markets. Service providers have expanded their payrolls for the eleventh consecutive month.7

#7. Spain

Current Power: 5 – Led by manufacturing and services

Momentum: 9 – Dropping with confidence

Overall Rank: 7 – Neutral Europe, Spain momentum contracting

Monetary Policy: 4.25%

Last change: Reduced Sept 2024

Valuation: Overvalued

Manufacturing growth hit its weakest point in seven months, with gains in new orders overshadowed by declines in output and employment. The manufacturing outlook has fallen to its lowest level in 2024, with concerns about future production impacting staffing, as many firms are choosing not to replace departing employees. Sentiment in the services sector also reached a 2024 low, although jobs were added to address capacity concerns. Meanwhile, rising salary costs are driving operating expenses higher.8

#8. Australia

Current Power: 11 – Manufacturing is a detractor

Momentum: 5 – Top 5, in 4 of 5 categories

Overall Rank: 8 – Further evidence of positive activity needed

Monetary Policy: 4.35%

Last change: Raised Aug 2023

Valuation: Overvalued

Manufacturing has contracted for the seventh consecutive time. However, exports grew at their fastest rate in nearly two years, boosting sentiment to its highest level in a year. High interest rates and subdued demand are negatively impacting domestic consumption. Despite this, confidence in the service sector is at its highest in a year, supporting sustained job creation within services.9

#11. United States

Current Power: 6 – Bottom 3 in Manufacturing

Momentum: 16 – Ranked second from the bottom in Manufacturing

Overall Rank: 11 – Equal weight

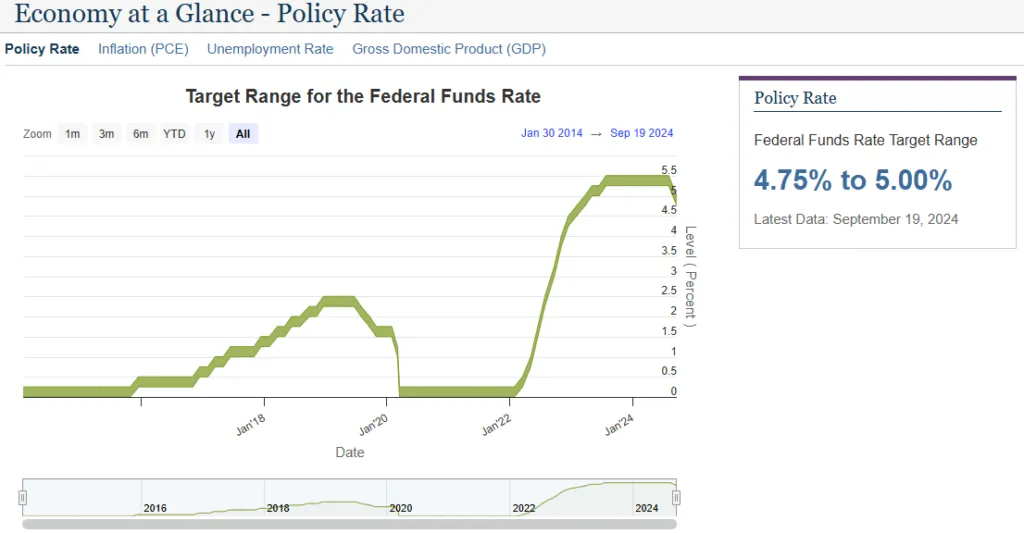

Monetary Policy: 4.75% – 5.00%

Last change: Reduced Sept 2024

Valuation: Overvalued

A decline in manufacturing demand has led firms to reduce output. Input cost inflation has accelerated to a 16-month high. The reduction in new orders is the most significant since June 2023. For the first time in 2024, staffing levels have decreased as firms respond to falling new orders and lower output by drawing down inventories and cutting workers. Meanwhile, service activity has risen at the fastest pace in nearly 2.5 years, although employment in the services sector has also decreased. There are emerging signs that the downturn in manufacturing may spill over into the broader economy.10

2024 Paramount Economic/Market Themes

(1) FEDERAL RESERVE WILL NOT CUT INTEREST RATES UNTIL SUMMER 2024, AT THE EARLIEST

(2) EARNINGS GROWTH IN THE UNITED STATES WILL NOT HIT DOUBLE DIGITS IN 2024

(3) UNEMPLOYMENT IN THE UNITED STATES WILL INCREASE ABOVE 4%

(4) THE DOLLAR WILL WEAKEN

(5) INTERNATIONAL STOCKS WILL OUTPERFORM

(6) SMALL CAPS WILL NOT OUTPERFORM

(7) IT IS A TIME FOR ACTIVE MANAGEMENT AND STOCK SELECTION, WITHIN SECTORS THERE WILL BE A WIDE DISPARITY BETWEEN WINNERS AND LOSERS

2024 Scorecard and Outlook

(1) FEDERAL RESERVE WILL NOT CUT INTEREST RATES UNTIL SUMMER 2024, AT THE EARLIEST

The Fed – Economy at a Glance – Policy Rate (federalreserve.gov); accessed 9/23/24

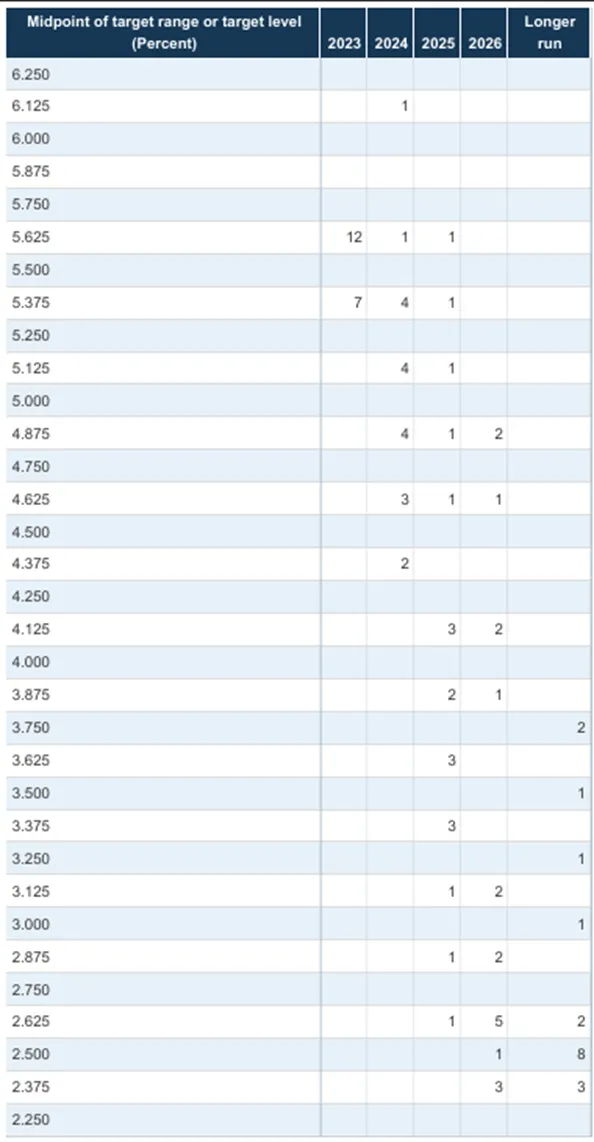

This was not a popular theme to begin 2024. Markets were expecting 6 quarter-point rate cuts throughout 2024. The economy exhibited strength and growth, job availability was abundant, and inflation persisted, even showing an increase through March. It’s important to note that the Federal Reserve lowers interest rates to assist the economy, particularly to encourage growth or to prevent job losses. Considering that to be the Fed’s mandate, I did not see a reason to reduce rates until some cracks began to show. Unemployment has ticked up recently with vacancies and hiring both down. Although major layoffs have not yet occurred, the rising unemployment rate itself poses a risk if consumers start thinking, ‘the job market is deteriorating, I should cut back on spending’. Below is the latest ‘dot plot’ from the Fed (participants offer guidance on the direction, this is not an official projection nor actual policy) and you can see the disparity amongst the voting members. Future inflation numbers and employment factors will be considered, and actual policy moves will be data dependent.

FOMC participants’ assessments of appropriate monetary policy: Midpoint of target range or target level for the federal funds rate

Number of participants with projected midpoint of target range or target level Make Full Screen

Note: Each shaded circle indicates the value (rounded to the nearest 1/8 percentage point) of an individual participant’s judgment of the midpoint of the appropriate target range for the federal funds rate or the appropriate target level for the federal funds rate at the end of the specified calendar year or over the longer run. One participant did not submit longer-run projections for the federal funds rate.

(2) EARNINGS GROWTH IN THE UNITED STATES WILL NOT HIT DOUBLE DIGITS IN 2024

This one, I was incorrect. Q2 2024 earnings per share growth rate came in at 11.3%11. To offer pretext, I could state that the year-over-year comparable added to the double-digit growth rate – however, no excuses here. Growth was stronger than expected, in fact the largest growth rate since Q4 2021. There are signs that revenue growth is slowing, and estimates for Q3 earnings per share are down over 35% since the end of June.

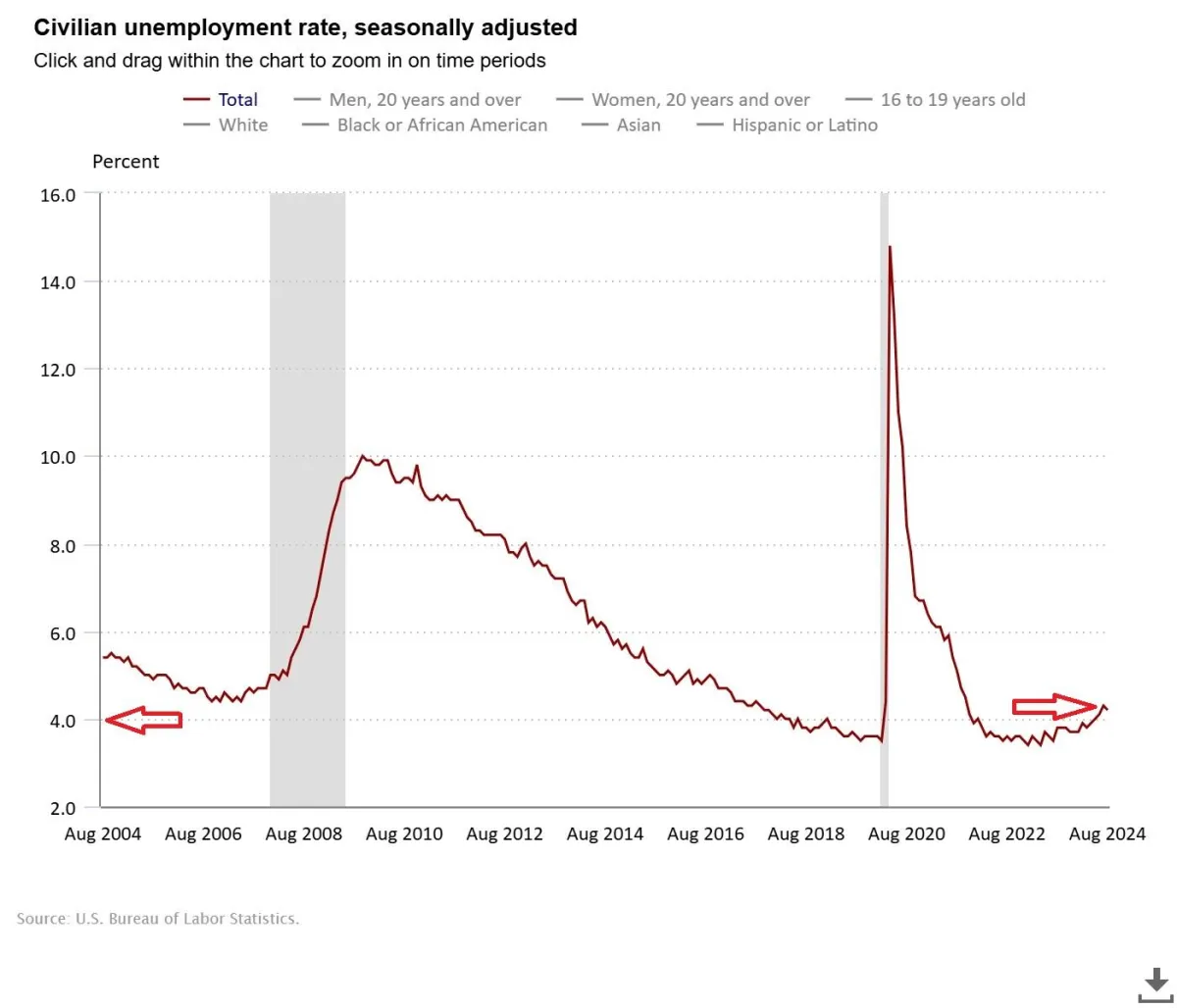

(3) UNEMPLOYMENT IN THE UNITED STATES WILL INCREASE ABOVE 4%

US Bureau of Labor Statistics; accessed 9/19/24

For the first time since the pandemic began, wage growth is now lower than the unemployment rate. While this section focuses on unemployment statistics, it’s important to note that wage growth has been nearly as significant an issue as housing inflation. Many businesses have struggled with higher wages, but increased worker productivity may help offset some of these costs. This impacts unemployment because, rather than hiring new employees, employers are demanding more from their current workforce. There are still more job openings than job seekers in the US. Quits have significantly decreased since the pandemic, and we haven’t seen mass layoffs. The labor force is aging both in the US and globally, and participation rates for those aged 18-64 are near all-time highs. In total the labor market is still tight, and employers are still struggling to find qualified candidates. The Fed does feel confident in attaining a soft-landing for the economy and in order to do so employment (pivot away from inflation) will be the focus going forward.

(4) THE DOLLAR WILL WEAKEN

I have to consider this a ‘mixed bag’. Beginning the year my expectation was for the dollar to weaken versus other currencies. However, as inflation remained sticky and earnings surged, the dollar gained strength as well. Following the Federal Reserve’s guidance on lowering rates, the dollar has experienced a notable decline. Currency valuations are determined by many factors, including:

Higher Interest Rates: When a country’s central bank raises interest rates, it often attracts foreign investors looking for the highest return on their investments. This increased demand for the country’s currency can lead to an appreciation in its value.

Lower Interest Rates: Conversely, when interest rates are lowered, it can lead to a depreciation of the currency as investors seek better returns elsewhere.

Interest Rate Differentials: The difference in interest rates between two countries can influence exchange rates. Investors might move their capital to countries with higher interest rates, affecting the relative value of currencies.

Economic Indicators: Interest rates are often adjusted based on economic indicators like inflation and employment. These adjustments can signal the health of an economy, influencing investor confidence and currency value.

FACTSET Advisor Workstation; accessed 9/17/24

My expectation for slowing growth led me to believe that the dollar would drop in value. For full transparency I changed my stance in February and made changes (that have since been taken down) to some international exposures. Today, these decisions are important with the divergence of monetary policy around the globe.

Why are currencies important? In many cases when investing internationally investors have a decision to make regarding investing in dollar-denominated investments or foreign currencies. Example: Total Return to Investors = Fund Returns (base currency) + Exchange Rate Fluctuations (base currency vs investor’s preferred exposure currency) Let us assume (1) Current Exchange Rate is 1 USD = 1 foreign currency unit (2) Dollar appreciates & the New Exchange Rate is 1 USD = 1.2 foreign currency units (3) This means that the Exchange Rate Fluctuation would be worth a gain of $200 for a $1,000 investment

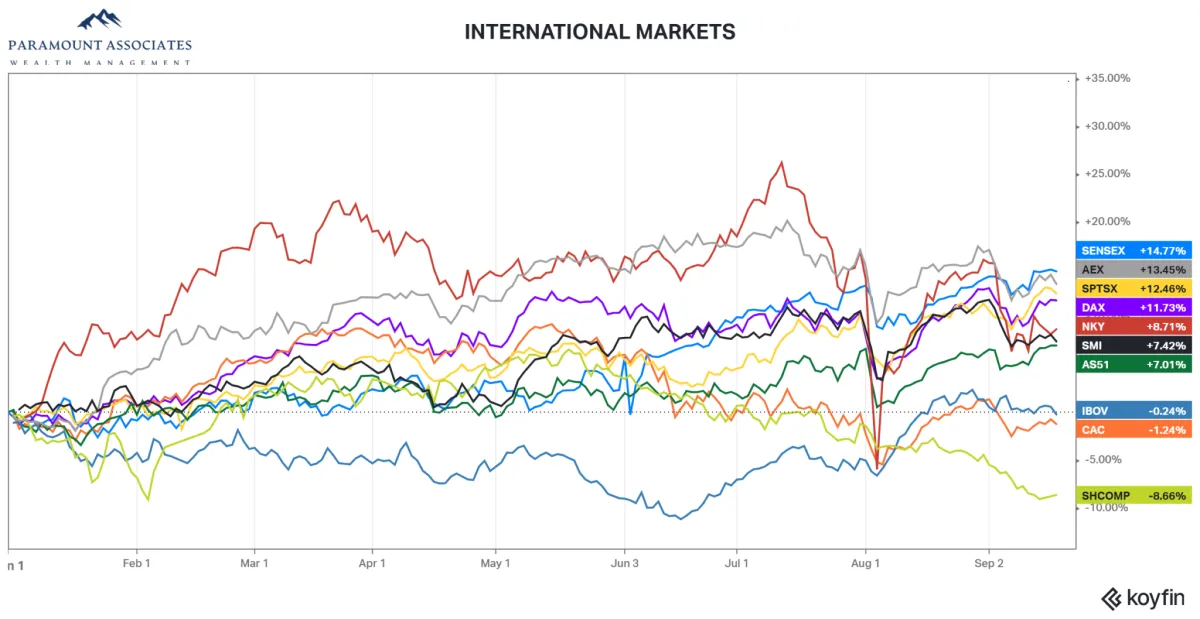

(5) INTERNATIONAL STOCKS WILL OUTPERFORM

Reviewing the Paramount Global Rankings throughout the year I notice a trend. The current strength of the global economy is dominated by the emerging markets. As for Europe, Spain is the only European country to crack the top 10 year-to-date. The United States does fall within the top 5 – tied with Spain for #5 overall year-to-date. The top 10 is comprised of the US, Spain, and 8 emerging countries.

Momentum rankings are more volatile, and year-to-date momentum rankings do include the United Kingdom, Spain, and Switzerland from Europe. The major players in emerging markets also do show up in the momentum rankings, except for China. The United States does not fall in the top 10 year-to-date on momentum.

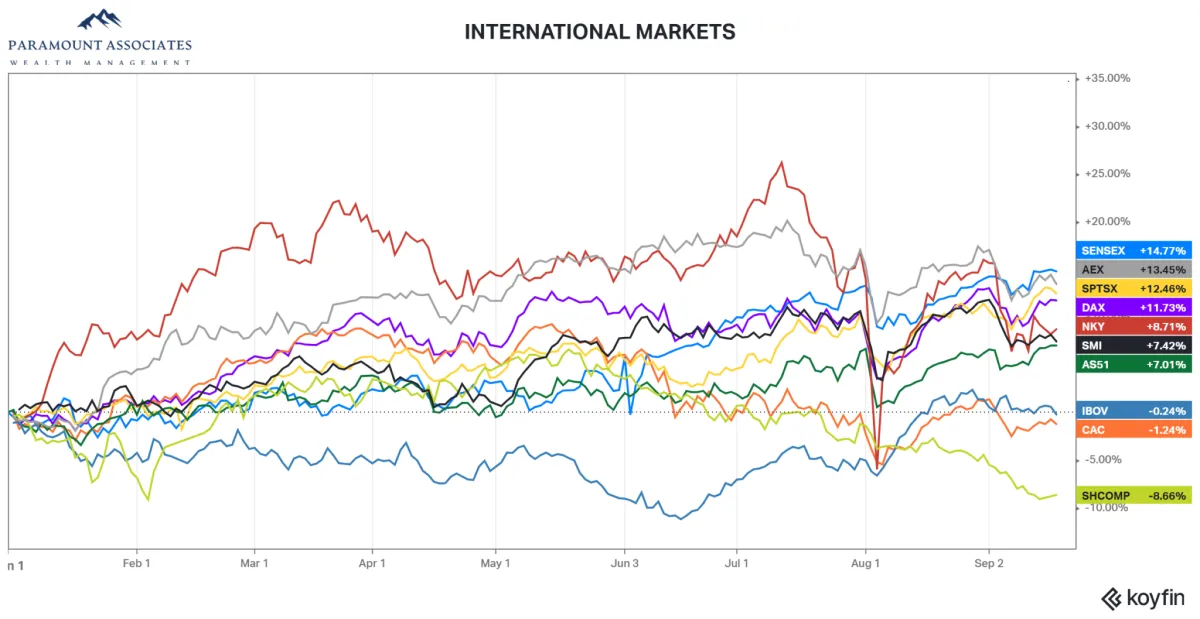

Year-to-date – Largest International Economies, Koyfin.com; accessed 9/19/2023

Going into 2024, I believed that US growth would slow, and the dollar would follow. As stated above, growth remained strong, and the dollar rode the wave up and back down. Overall, the broad-based international indices have not outperformed US stocks. Fortunately for our investors, our foreign investments in India and the United Kingdom have outperformed. Dollar denominated in investments in Japan and Europe had pockets of outperformance as well. We currently have less than 1% of total equity exposure in China. China has been fighting against a complete real estate collapse – remember how that economy felt back in 2007? Measures taken by the Peoples Bank of China are needed in order to correct the confidence issue that is holding back the Shanghai Stock Exchange.

JAPAN – An important part of deciding which assets in which to invest is managing the overall risk of the portfolio. There are times when increased volatility or risk outweighs the potential reward. Japan is in an interesting situation where job growth is strong, service growth is strong, and the Bank of Japan is starting to get increased inflation which they hope leads to increased domestic consumption. These are positive aspects, yet they also present a chance to observe the impact of currency valuation fluctuations on foreign investments.

YEN CARRY TRADE:

What is a Carry Trade? It is when an investor borrows a less expensive currency (in this case yen vs dollar) to invest in the stronger currency. Some investors go a step further and then use the stronger currency to purchase other investments. This strategy may be profitable if the currency remains less expensive. However, if the currency gains strength and in turn the funding costs of the strategy this is can create negative returns. Recently, the Bank of Japan raised its interest rates, while concurrently, Federal Reserve officials signaled a reduction in U.S. interest rates. Movements in central bank policies often influence currency valuations. In this case, the yen appreciated quickly, further driven by investors covering their short positions on the yen. This surge led to a nearly 20% drop in Japanese stock markets within two days. Although international markets have partially recovered, the divergence in monetary policies and the narrowing currency spread may lead to increased volatility, potentially offsetting the positive economic trajectory.

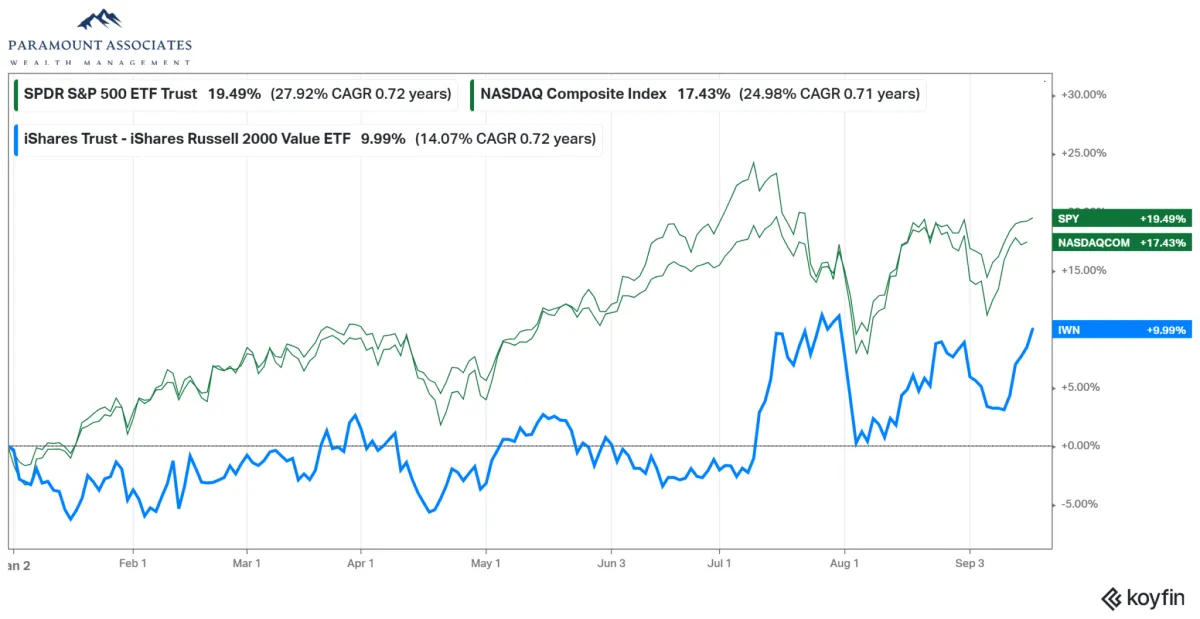

(6) SMALL CAPS WILL NOT OUTPERFORM

WHY DO INVESTORS BELIEVE SMALL-CAP STOCKS WILL OUTPERFORM WHEN RATES GO DOWN?

1.Lower Borrowing Costs – Small-caps typically have higher levels of debt than large-cap companies. Lower interest rates reduce their borrowing costs

2.Economic Sensitivity – Small-caps are generally more sensitive to economic conditions. When interest rates are lowered, it often signals an effort to stimulate economic growth

3.Valuation and Growth Potential – Small-caps often trade at lower valuations than large-cap stocks. When rates and the cost of capital drops, this could potentially lead to higher valuations and growth prospects for small-cap companies

4.Increased Investor Appetite for Risk – Lower interest rates can lead to a search for higher returns, prompting investors to move from safer investments to riskier assets like small-cap stocks

There has been much discussion this year about small-cap stocks, value stocks, versus large-cap growth technology stocks. Throughout the year I have been reducing large-cap growth technology in favor of utilities, insurance companies, and industrials. I do see broadening as the way of least resistance however I am not in favor of small-cap stocks given the current economic backdrop. I see rate cuts as measured so the significant cost savings in borrowing capital will take some time. The biggest drawback is economic sensitivity. I admit that earnings growth has been stronger than I expected. Yet, I am also seeing earnings estimates coming down, and most importantly revenue projections dropping as well. This doesn’t mean I foresee a recession (I made it this far without mentioning recession) however slowing revenues and increasing unemployment do not lead me to believe in a roaring economic backdrop that would favor small-cap stocks.

Year to Date through 9/19/2024, Koyfin.com; accessed 9/19/2024

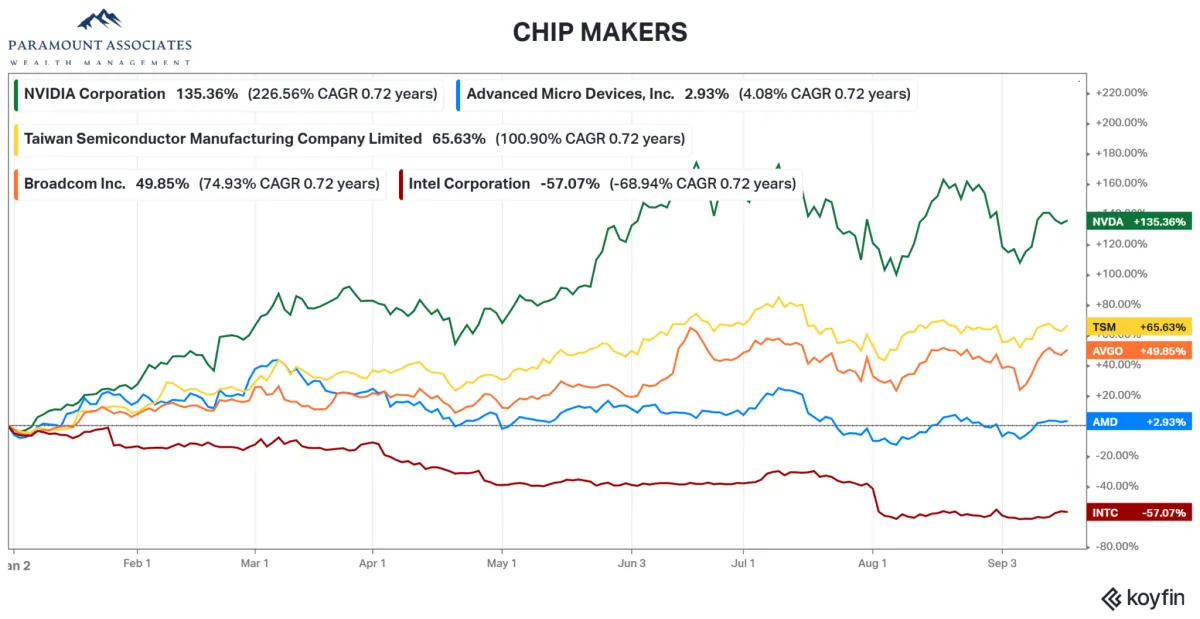

(7) IT IS A TIME FOR ACTIVE MANAGEMENT AND STOCK SELECTION, WITHIN SECTORS THERE WILL BE A WIDE DISPARITY BETWEEN WINNERS AND LOSERS

Below are two examples of disparity year-to-date. The initial chart highlights the disparities within sectors, showcasing the stark contrast between the highest-performing chip manufacturers and the least successful ones. The second chart presents the various global markets and their respective stock market performances, highlighting significant discrepancies throughout. I would argue we are not in a buy-and-hold stock market and what is in favor will change quickly over time. I expect greater volatility as the year progresses and the election grows closer. Whether we are discussing stocks within sectors, countries in which to invest, money managers to hire – I foresee this disparity to become an even greater point of emphasis.

Investor Education

HOW DO RISING INTEREST RATES AFFECT BONDS?

Bonds and interest rates have an inverse relationship. If interest rates rise, investors will prefer higher paying bonds. Investors then sell the lower paying bonds, driving down those bonds’ prices.

HOW DOES THE FEDERAL RESERVE AFFECT THE BOND MARKET?

The Federal Reserve controls the federal funds rate. The federal funds rate is the target rate at which commercial banks borrow and lend their excess reserves to each other overnight. This influences short-term rates on consumer loans, credit cards, and new bond issues. If new bond issues must keep up with the federal funds rate to create demand, lower paying bonds are sold pushing down those bond prices.

HOW DOES THE FEDERAL FUNDS RATE AFFECT INFLATION?

In general, when interest rates are high, the economy slows, and inflation decreases. But why? If rates are high, consumers have less money to spend. Investors tend to save more because savings returns are higher. Additionally, loan demand decreases as borrowing costs increase.

SHOULD I ASSUME THAT THE 10-YEAR TREASURY WILL INCREASE ALONG WITH THE FEDERAL FUNDS RATE?

Normally the 10-year treasury yield is a precursor to expected increases in the federal funds rate. It will move ahead of the Federal Reserve and set market expectations. Historically rates have actually decreased after fed funds rate escalation. For two reasons: (1) Bond markets have a tendency to overprice actual Federal Reserve policy changes, (2) Investors expect economic growth to slow with higher rates and move to safer assets.

HOW DO RISING INTEREST RATES AFFECT STOCKS?

Generally speaking, rising interest rates are not welcomed by stock investors.

By raising interest rates, the Fed is increasing borrowing costs

Rising interest rates would encourage people to save more with higher savings yields

Credit card and other variable debt payments become more expensive slowing demand due to less consumer liquidity

Decreasing money supply in the system means a slower economy and less inflation

Dividends and Earnings are discounted to the new increased interest rates

Usually Federal Reserve interest rate hikes take 12 months for widespread economic impact

ARE ALL EQUITY SECTORS AFFECTED EQUALLY?

No, some sectors actually benefit such as financials. In contrast, high valuation firms (or firms without positive earnings) feel the greatest negative impacts.

DO RISING RATES AFFECT CORPORATE EARNINGS?

REFERENCES

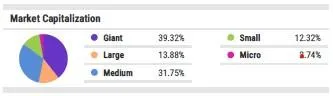

1 YCharts, Portfolio Allocation Overview, accessed 9/23/2024

2 HSBC India Manufacturing PMI®, HSBC India Services PMI®, S&P Global, accessed 9/04/2024

3 Caixin China General Manufacturing PMI Press Release, Caixin China General Services PMI Press Release, S&P Global, accessed 9/04/2024

4 S&P Global Brazil Manufacturing PMI®, S&P Global, accessed 9/02/2024

5 S&P Global UK Manufacturing PMI®, S&P Global UK Services PMI®, accessed 9/04/2024

6 S&P Global South Korea Manufacturing PMI®, S&P Global, accessed 9/02/2024

7 au Jibun Bank Japan Manufacturing PMI®, au Jibun Bank Japan Services PMI®, accessed 9/04/2024

8 HCOB Spain Manufacturing PMI®, HCOB Spain Services PMI®, accessed 9/04/2024

9 Judo Bank Australia Manufacturing PMI®, Judo Bank Australia Services PMI®, accessed 9/04/2024

10 S&P Global US Manufacturing PMI®, S&P Global US Services PMI®, accessed 9/05/2024

11 Ig.com, US earnings season Q2 2024: Strong growth amid mixed signals, Chris Beauchamp, accessed 9/12/2024

12 Forbes, What Impact Could Rising Rates Have?, accessed 2/18/2022

13 Yale School of Management, Roger C. Ibbotson, The Popularity Premium, accessed 12/14/2021