Monthly Report: September 2022

Which way do we go from here?

Year to date (through 8/31/2022):

the Dow is down -13.29%1,

the S&P 500 is -17.02%1 lower,

the NASDAQ is -24.47%1 lower,

and Bonds (measured by AGG, iShares Core US Aggregate Bond ETF) are -10.67%1 lower.

The picture above says ‘COST’; and in today’s market COSTs OF GOODS/SERVICES and STOCK MARKET have a direct inverse relationship.

Markets are continuously attempting to price in what the Federal Reserve is going to do to combat inflation, how is monetary tightening going to affect corporate America, and what are going to be the triggers to change the Fed’s path.

Estimates on the Fed’s path are very volatile and can change drastically after just one press conference. Generally, the market is pricing in 3.50% by year-end 2022, 4% by year-end 2023, and 3.75% by year-end 2024. As of September 5, 2022 the 12-month Federal Funds Rate Futures are pricing in 3.72%2.

These are the statistics that the market is currently pricing in. So what do I think, you ask?

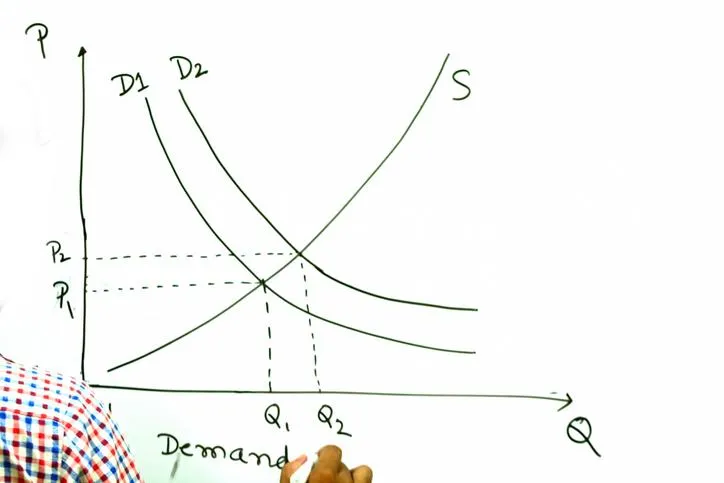

I think that The Federal Reserve will be able to slow the trajectory of monetary tightening due to natural economics slowing inflation. Simple supply and demand has pushed inflation to levels not seen in 40 years. Let’s remember where we came from: To begin 2020 U.S. corporations were enjoying all-time margins. In business, margins are the differences between the price of a good or service and the amount of money required to produce it. Markets were healthy, jobs were plentiful, and then Covid-19 hit the U.S. The Federal Reserve and the U.S. Government acted promptly by providing necessary stimulus as the normal course of business came to a screeching halt. In the U.S., roughly $5 trillion went to households, small businesses, restaurants, airlines, hospitals, local governments, schools and other institutions around the country grappling with the blow inflicted by Covid-19. Globally $10 trillion entered the system in various forms of aid. All that money increased Money Supply at a time when Supply Chains negatively affected nearly 40% of small businesses in the U.S., 94% of Fortune 100 companies, and caused stock-outs for 28% of all retailers3. EXCESS FUNDING + DECREASED SUPPLY = INCREASED INFLATION.

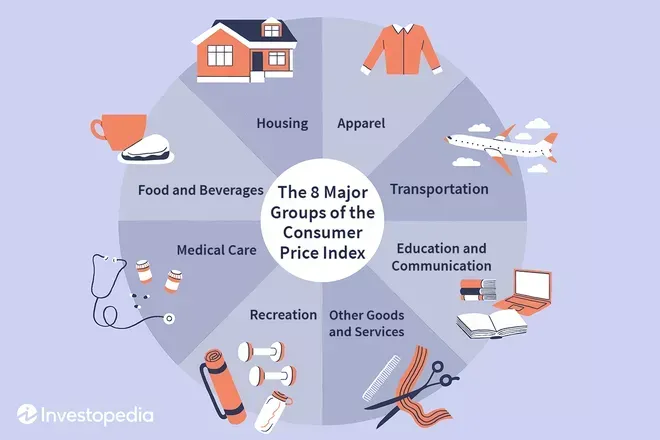

Going forward, I expect that inflation will turn to deflation over the course of the next year. I do think that some areas will unwind with impact. In fact we are now seeing evidence of this with the two biggest components of the CPI (Consumer Price Index). Housing itself makes up almost 35% of the CPI index. Among 97 regional housing markets measured by Redfin, the average market saw 34% of home listings get a price cut in July. That’s the highest-ever reading on Redfin. It’s also well above the 25.7% in May 2022, and 21% in July 20214. In July, housing prices dropped for the first time in 3 years. Fitch ratings projects a -10% to -15% drop in real estate prices over the next year4. Moody’s doesn’t think we will see quite the same drop, but projects 0% growth over the next year.

Investopedia / Maddy Price

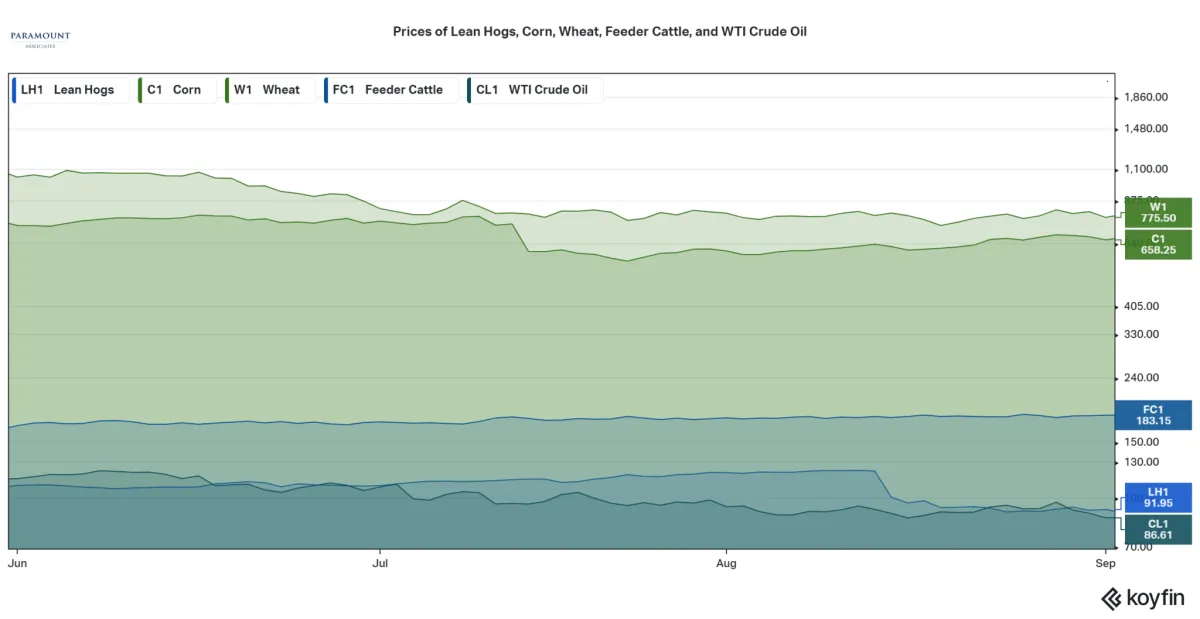

We are also seeing price reductions in food and gas. Housing and food are the two largest components of the CPI Index.

PRICES OF FOOD AND GAS LAST 3 MONTHS

Housing, food, and gas are the three components of inflation that Americans feel the most. While we have seen evidence that prices are moderating that doesn’t mean that we will see a clean sweep off dropping prices for all components. Take housing for example – I do not expect that rental payments will fall as quickly as home prices themselves. It may be that rents remain stagnant for some time; what rationale does a landlord have to lower rents until competition makes that necessary? Or food costs – why would Wendy’s lower the costs of their meals, if they don’t have to? These questions are valid and the answer again is in the economics of the transaction. Here is an example – Let’s say McDonalds decides to lower prices to increase demand as their food costs begin to come down. What does Wendy’s do then? Wendy’s will lower prices accordingly so that demand does not falter. This is an example of free market capitalism, albeit I admit the forces sometimes take longer than anticipated.

What is the market expecting? Remember that markets (stocks and bonds) attempt to price in the Federal Funds Rate before the Federal Reserve actually increases/decreases rates.

Expectations for Fed policies have increased recently. In June the market expected the Federal Funds Rate to finish 2022 around 3.35% and now that has increased to 3.5%.

GDP (Gross Domestic Product) forecasts for the U.S. have dropped almost 50% on average since the beginning of 2022. Keep in mind, this is still GROWTH.

Unemployment has increased to 3.6% (from 3.5%) and there are estimates that unemployment will increase over the next couple of years. The Federal Reserve projects unemployment to increase to 4.1% by 20245. This is one statistic that there is wide range of possibilities – Fannie Mae forecasts 5.5% unemployment by the end of 20236. For the record – I do not agree with that drastic of a change.

Corporate Profits are still expected at 10% growth for 2022. Although 2023 estimates have been reduced, profits are still expected to rise by 5% in 2023.

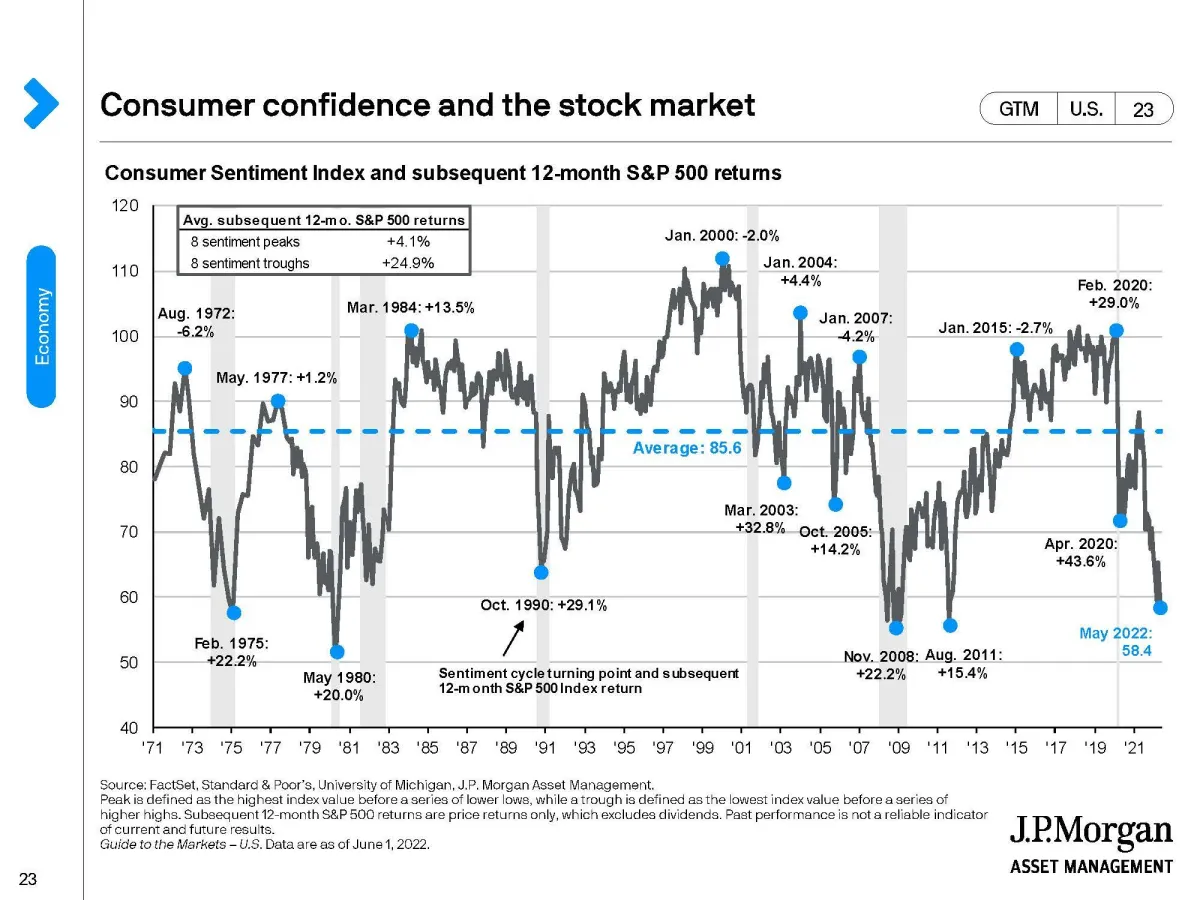

With this backdrop what is portfolio strategy? Big picture: In June of 2022, The University of Michigan Consumer Sentiment survey hit an all-time low7. That was a major buying signal for our portfolios. Equity allocations increased after 7 months of underweight allocations. Investments to quality growth companies and emerging markets were made. I think that inflation will be 5.5% by year-end and my expectations are that inflation will come down drastically in 2023. Employment and earnings are still strong and I see that continuing. New hiring may slow and we may see some layoffs, but there are still millions of open positions waiting to be filled. Earnings will continue to be strong as I don’t see wages coming down drastically anytime soon. In fact, in the first quarter U.S. GDP dropped -1.6% earnings increased by 1.8%8. This is abnormal and demonstrates the strength of the U.S. consumer in the face of rising inflation. Interest rates have increased however I don’t see rates continuing course. The natural rate of interest has shifted downward due to demographics and slower productivity growth. There are opportunities around the globe as different central banks (China) take different courses based on current economics within. I do expect the market volatility to continue as markets attempt to price in the future of Federal Reserve policy. Overall, remember that the best buying opportunities for risk assets are when the consensus is at its very lowest.